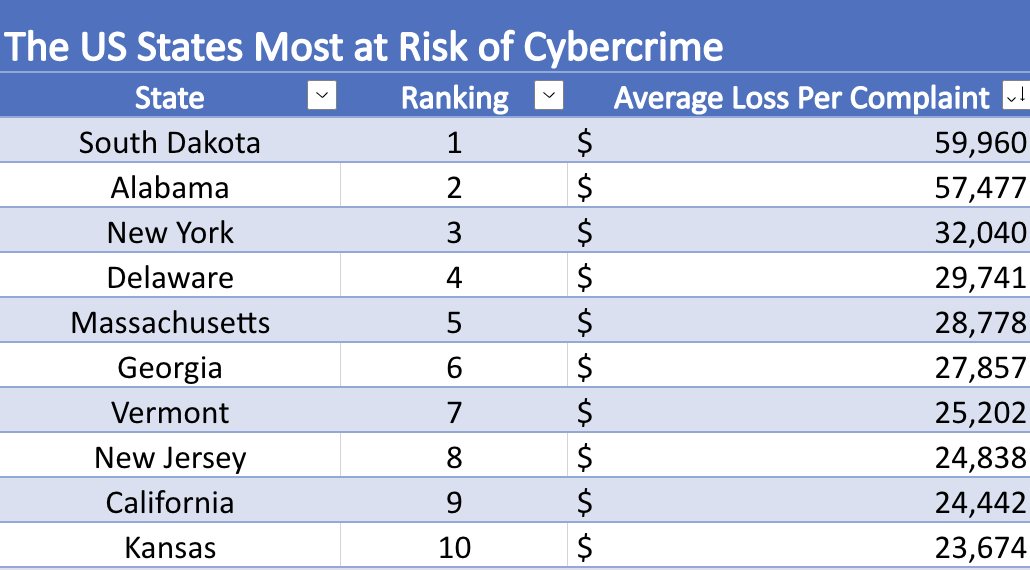

Did you know that South Dakota is the state most at risk of cybercrime, with an average loss of $59,960 per fraud complaint?

The experts at sprinto.com analyzed the most recent data from The Internet Crime Complaint Center (IC3) on the US states most at risk of cybercrime attacks to underscore how individuals and businesses across states can exercise safeguards.

Alabama is the second most at risk state, with an average loss of $57,477 per complaint. The most frequent types of cybercrime are non-payment/non-delivery, personal data breach, credit card fraud, identity theft and social media.

New York ranks third, with an average loss of $32,040 per complaint. The most frequent types of cybercrime in New York are non-payment/non-delivery, identity theft, personal data breach and social media.

The top ten is rounded out by Delaware, Massachusetts, Georgia, Vermont, New Jersey, California and Kansas.

At the other end of the scale, Indiana saw the lowest losses from cybercrime, with an average loss of $5,430 per fraud complaint.

The research reveals personal data breach is amongst the leading types of cybercrime in most states, as well as non-payment/non-delivery, extortion and social media fraud.

The research also reveals that Business email compromise (BEC)—also known as email account compromise (EAC) – is the costliest type of fraud, ranking as the number one most costly across 42 states.

Frauds have been increasing every year in the US. The FTC’s Consumer Sentinel Network data book received 5.74 million reports of fraud in 2021, up from 4.87 million in 2020, representing an 18% increase.

Organizations are losing an average of 5% of their revenue to fraud each year, and the estimated cost of fraud for US financial institutions in 2021 was $4.2 billion.