Photo Courtesy: Apple

Photo Courtesy: Apple

The buzzed-about Apple Pay is launching in the U.S. on Monday, October 20th. We already have easy-payment apps, such as Venmo and banking mobile pay programs. So before Apple Pay reveals itself to all iPhone and iPad users, let’s see if and how AP is different from the rest.

First, how do you get it? The new service will be enabled by a free software update to iOS 8. “Our team has worked incredibly hard to make Apple Pay private and secure, with the simplicity of a single touch of your finger,” said Eddy Cue, Apple’s senior vice president of Internet Software and Services.

The main goal and feature is for the progam to wipe away any worries of fraud or bank info security breaches. How does it do that, you may ask? It doesn’t collect any transaction information that can be tied back to a user and payment transactions are between the user, the merchant and the user’s bank. Apple doesn’t collect your purchase history, so when you are shopping in a store or restaurant we don’t know what you bought, where you bought it or how much you paid for it. Actual card numbers are not stored on the device, instead, a unique Device Account Number is created, encrypted and stored in the Secure Element of the device. The Device Account Number in the Secure Element is walled off from iOS and not backed up to iCloud®.

Big businesses are jumping on board. Whole Foods Market co-CEO Walter Robb said, “We are thrilled to be one of the first retailers to accept Apple Pay across all of our locations nationwide as it offers our shoppers a fast, private and secure check out option at our stores.”

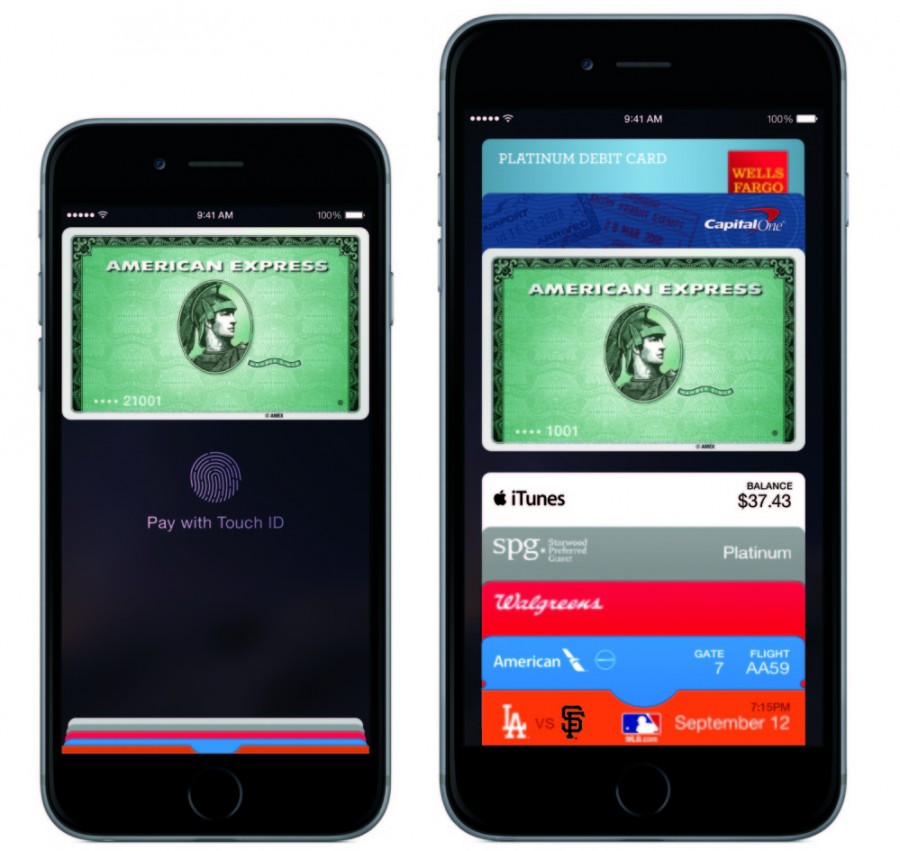

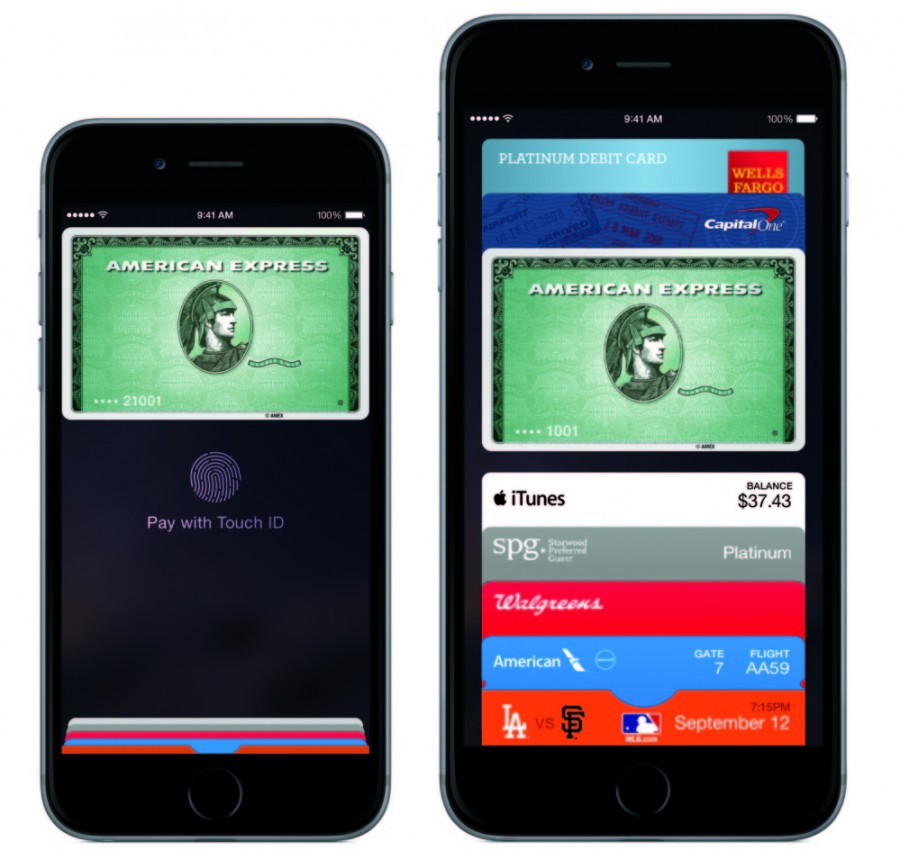

Who can use it? Apple Pay supports credit and debit cards from the three major payment networks, American Express, MasterCard and Visa, issued by the top US banks. In addition to American Express, Bank of America, Capital One Bank, Chase, Citi, Wells Fargo and others, who announced support in September, more than 500 new banks from across the country have signed on to Apple Pay. Users can make purchases in stores and within apps, with credit cards issued by many of the leading banks nationwide, which make up 83 percent of the credit card purchase volume in the US.

So, once Apple Pay is uploaded, how do you use it? Hold your iPhone near the contactless reader while keeping a finger on Touch ID. In addition to the 262 Apple retail stores in the US, availability from leading retailers at launch include: Aéropostale, American Eagle Outfitters, Babies”R”Us, BJ’s Wholesale Club, Bloomingdale’s, Champs Sports, Chevron and Texaco retail stores including ExtraMile, Disney Store, Duane Reade, Footaction, Foot Locker, House of Hoops by Foot Locker, Kids Foot Locker, Lady Foot Locker, Macy’s, McDonald’s, Nike, Office Depot, Panera Bread, Petco, RadioShack, RUN by Foot Locker, SIX:02, Sports Authority, SUBWAY, Toys”R”Us, Unleashed by Petco, Walgreens, Wegmans and Whole Foods Market. In addition, many others will add support this year, such as Anthropologie, Free People, Sephora, Staples, Urban Outfitters, Walt Disney Parks and Resorts and more.

Apps with the ability to use Apple Pay at launch include: Apple Store app, Chairish, Fancy, Groupon, HotelTonight, Houzz, Instacart, Lyft, OpenTable, Panera Bread, Spring, Staples, Target and Uber. Many more will support Apple Pay by the end of this year with popular apps such as Airbnb, Disney Store, Eventbrite, JackThreads, Levi’s® Stadium by VenueNext, Sephora, Starbucks, StubHub, Ticketmaster and Tickets.com, among others.

Leading payment solution providers and terminal suppliers such as Adyen, Authorize.Net, Bank of America Merchant Services, Braintree, CyberSource, Chase Paymentech, First Data, Heartland Payment Systems, iMobile3, NCR, Oracle’s Micros, Stripe, TSYS and VeriFone, among others, are working to bring merchants in stores and in apps the ability to easily, securely and privately accept payments using Apple Pay.